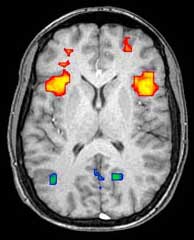

A friend recently told me about how they did a brain scan of Warren Buffett and discovered that when he did a simulated payment it lit up the insula portion of his brain, which is associated with pain and other emotions. This was only half true. For savers they did do a brain scan for this activity and the findings are in this article. However, they never did it on Buffett himself, unfortunately.

I can completely relate to the finding in this article. I also cannot relate to the "spenders" highlighted in the article either. The idea of gaining pleasure from spending money is foreign to me. I have learned to mold my spending habits into what appears to be stranger mannerisms, or so I thought until I read this article. I came to find out that I just ended up doing it correctly.

I divide my spending habits into 2 categories and have been doing so for about 10 years. Firstly, the one extreme I have needs (food, water, shelter, clothing, transportation, etc.) and secondly, I have regrets. I pay for both of these with credit cards. I do this partly because I get rewards, but also because if I had to pay cash than I might never do the regrets. The regrets are things that I will end up regretting doing later in life if I don't do them now. I've referred to these in the past as "death bed decisions". I make these decisions based upon what my thought process would be on my death bed. Will I regret not getting that cup of coffee? Meh. Will I regret not buying that $100 Gucci underwear? Fuck no! Will I regret not seeing the Taj Mahal? Duh! What about the running of the bulls in Pamplona?? OMFG when can I go again! Ahh now we're starting to see the difference...

While we will never be able to understand the difference between the spenders and the savers, it is essential that we at least close the gap. Why? Because the spenders often end up penniless in their later years and the savers end up with a death bed full of regrets. For ways to close this gap read the article above. But if you remember one thing from this post, remember this: save and spend with reckless abandon! Live life in the extremes, that's where the fun is!

-CC

RSS Feed

RSS Feed