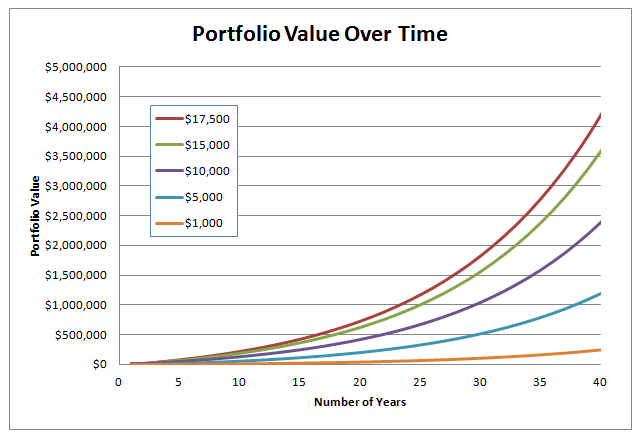

Well you're going to need to put away $5,000 a year for the next 40 years. You'll save $1,250 on taxes by contributing to your 401k. The company will also contribute $1,500 to match your contribution. This means that you actually only need to contribute $2,250 per year!

The $1,250 + $1,500 in employer matching + $2,250 = $5,000. You do this over 40 years and all that you end up contributing is $90,000. That's right you save $90,000 and you end up being a millionaire!

How much do you end up with if you save the full 10% of your income? The full $5,000 plus the other two benefits of tax savings and employer contributions this comes out to a approximately $1,500,000.

RSS Feed

RSS Feed