All three of these are linked and also contradictory. I think you should employ all three.

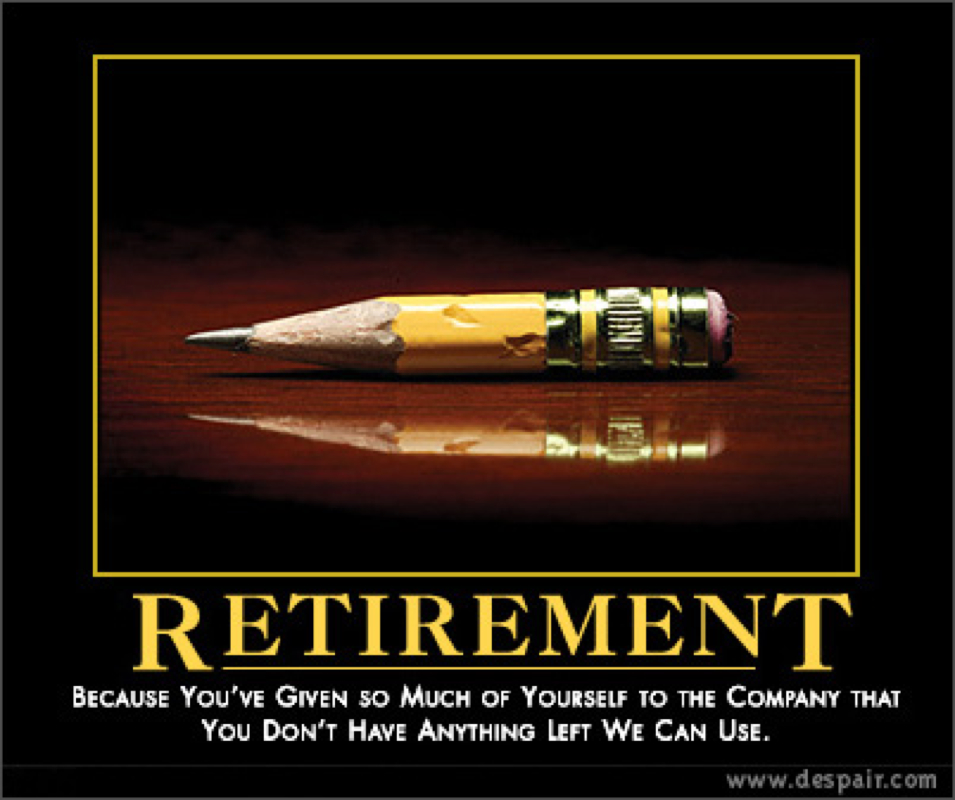

RETIREMENT

This is the ultimate goal. To not to have to work and spend your one life (I apologize to the Buddhists and Hindus) doing what you love is a travesty. And this view point has only become possible in the last few generations. Since the beginning of time we've been consumed with trying to feed ourselves and stay alive. Due to modern agriculture and vaccines we have enough breathing room to live a majority of our lives without having to labor.

Retirement has meant different things to each generation. Prior to the greatest generation there was little to no retirement for the unwashed masses. Retirement for the greatest generation just meant not having to work and being able to live out your last years in dignity. The baby boomers came along and wanted more (of course they did). They wanted decades of care free living while traveling and visiting grand kids. My generation has the opportunity to up the ante again. Why spend your best years working? Why do I have to work most of my life? These are the people who have found a way to travel around the world for a year or more while being completely broke. This would have been unimaginable to my grandparents.

This trail is being blazed by the likes of Tim Ferriss, Jacob Fisker, and Mr Money Mustache who started asking, "Why does it need to be this way?". They've reset their lives to reject consumerism and to look at what's really important in life.

MINI RETIREMENT

I first heard this from Tim Ferriss in THE 4 HOUR WORKWEEK. He was fed up and close to a breakdown in his 20s. He stepped back and said there had to be a better way. He's a big advocate of building up cash hordes and using them to take mini retirements of a few months to a few years. Enjoy life while you're young enough to live it. One of my grandfathers worked very hard his whole life to retire and then travel the world with his wife.

On the first leg of that trip he got sick and had to return home. He never recovered enough to leave again. Don't stand around waiting for the bus to hit you. It always eventually will.

NEVER RETIRE

I completely mean this. I read a book in high school named DIE BROKE. The author advocated working full time your whole life until you dropped dead. He was an idiot, but he got one point right. Even when you retire you should find a small job that you enjoy and can hopefully make a little bit of money at. If you're able to pull in a measly $5,000 a year for 40 years (7% ROI) and not spend it you'll end up with over $998,000 to help in case you run low on funds.

This also helps you keep up your skills in case you need to go back into the workforce.

RSS Feed

RSS Feed