If you're nearing retirement it could be a detrimental time to do so. The stock and bond markets are very expensive now giving the illusion of wealth.

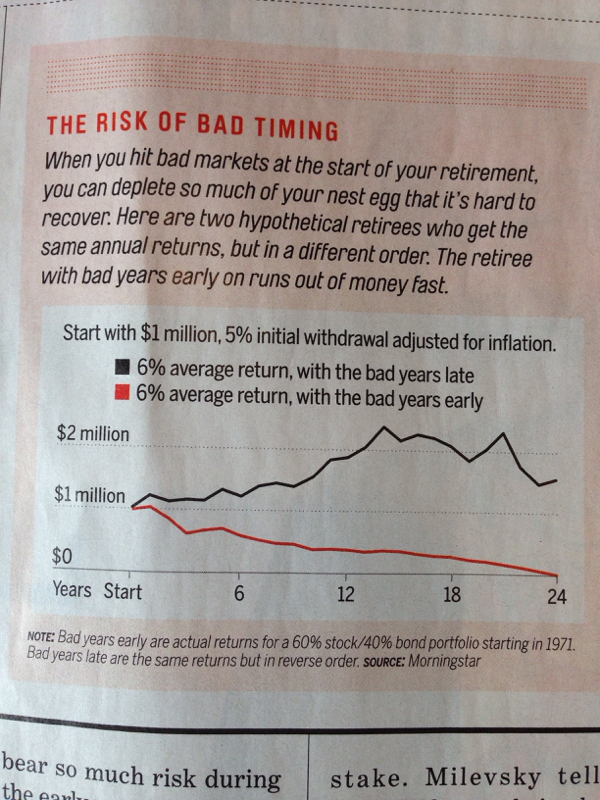

A recent study done where a person retired right before a market crash and then where a crash didn't happen until 10 years into retirement. The results in 24 years are astounding!

Both started with $1,000,000 and both had a 6% return for those 24 years. For the person who retired just before the market they were out of money 24 years later. For the person who retired 10 years before a crash they had $1,500,000 million in assets! Huge difference!

So how do you combat this? Start moving money into bonds 10 years before you retire. Depending upon your age you should have half or more of your securities in bonds. If you can live just off the interest that's the best. Also wait until the market crashes and then rebounds before retiring. It would also be good to have a few years in cash to live off of in case the market does crash. That way you don't have to withdrawal money while the assets are depressed. That's the whole key!

-CC

RSS Feed

RSS Feed