I was perusing MLS listing for Orlando when I ran across a duplex. Should it be bought or be pasted on? Let's look at the numbers first. Looking at the numbers first is the quickest way to weed out the bad ones. If it passes the numbers then you need to look at the softer variables.

Duplex for $525,000. 3 bedrooms with 2.5 bathrooms in each with a one car garage for each. Built in 2006. 3,500 square feet for both. Block first floor with frame second floor. Hardwood floors, stainless steel appliances, granite counter tops and stucco exterior. Very nicely done. Zero lot line with small yard in the front. Within a few miles of downtown and is considered downtown living area.

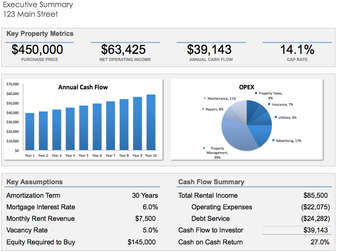

You should be able to talk the owner down to $500,000. Assuming a 20% down and a commercial mortgage rate of 4.75% (Bank of America) you're looking at a mortgage payment of $2,087. $50 to mow the lawn each month, $100 in misc repairs, $125 each month for insurance, and property tax of $802 a month (Wowsers!). All of this comes up to expenses of $3,164 a month. To break even with cash flow you would need to rent it 100% of the time for that amount.

Rent: according to the going rate of the surrounding areas similar units are renting for $1.14 per square foot per month. That would put rent for these two units at $4,000 per month. From what I've seen this looks reasonable. Always be conservative though. So I would suggest running the numbers at $3,600 a month with a 5% vacancy rate. That would put rent at $3,420 per month. That would give us a conservative monthly free cash flow rate of $256 per month. If you want to mow the lawn yourself that could be $300. That'll earn you about 3% on your month.

If the property increases at 3% a year, along with the principle that you get from the mortgage payment than you could be making 24.6% return on your investment after you get done selling it. This is pretax. If you can get $4,000 in rent than you're talking about an 8% return on cash and an ultimate 28% return on the entire investment after you sell.

So it's cash flow positive and by a healthy enough margin. That criteria has been met. Now what about the soft areas like crime, schools, neighbors, parks, relation to highways and other structures. This is where it gets harder and murkier. The neighborhood in my opinion isn't the best, but not bad. The school district is ok for middle school but the high school sucks. It's close to toll road 408, but not so close that you can hear the traffic. Close to downtown (pro). Close to executive airport (con). The planes literally fly right over the house for certain wind conditions. The good thing is there are small private prop planes so they're not that loud. According to the crime heat map on trulia.com crime isn't much of a problem but there are occasional domestic disturbances. The neighboring homes look good but not great. I think this area is going through a positive transition like all areas around downtowns. There's a nice shaded park at the end of the street.

None of this looks bad, except for the school district. You can ignore this if it looks like you have a property that will exclusively be rented to DINKS (Double Income No KidS). They don't care what school district they live in for obvious reason. This in turn will reduce the number of people who will look at and ultimately rent your duplex. Which in turn could make it harder to rent and also lower the rent yield.

It's for this one reason as to why I haven't pulled the trigger yet. To quell my nervousness I would really like to see what the current owner is renting them for and also how vacant it has been. When I rode my bike by the place it looked like it was fully rented with some nice cars in the driveway. I'd like to know what they're paying.

In the mean time I'll keep looking...

RSS Feed

RSS Feed