-Tyler Durden

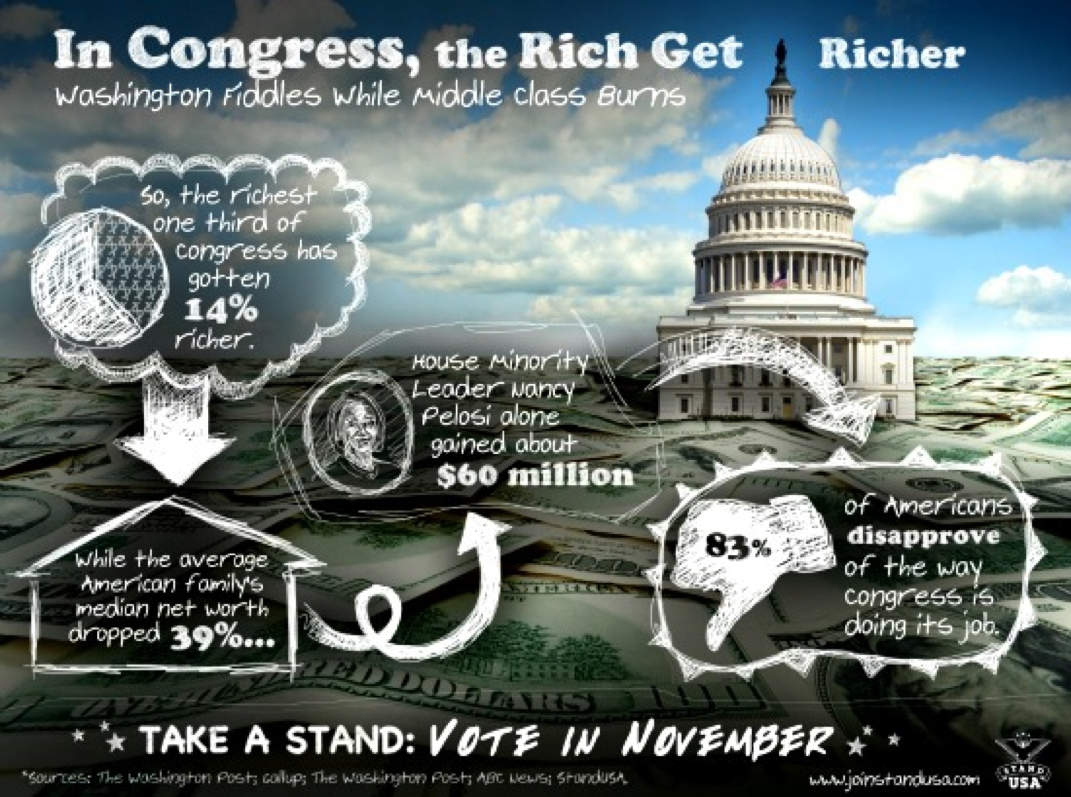

I love these cartoons demonizing others for your current situation. Makes you feel warm and fuzzy, right? This one is especially good because it attacks both of them! You can blame the rich and the government for your place in life. You can blame racism or your up bringing. But I'm going to tell you, the average American, something that nobody else will. It's your fault!

The reason the rich are getting richer and the poor are getting poorer is because of mathematics. Let me explain, the rich have assets, which grow. The poor have to grow their base. It's a function of saved cash, not class warfare or government policy. If you want to get rich, you need to save money in order to acquire more cash flow producing assets. It really is as simple as that, the rest are just details.

Now be honest with yourselves. Go stand in front of the mirror and ask yourself truthfully, if the government lowered my taxes and allowed for me to keep more of my money that I earned. Would I actually keep it or spend it? Yes, some of you would, but seeing as we already have one of the lowest overall tax rates in the industrialized world and we also have the lowest savings rates of anybody. I'm guessing you're lying to yourself if you answered 'yes'. So quit blowing sunshine up your own ass and take control of your situation.

When I read about the prosperity of early Americans who came here for a better life. Many leaving government and aristocracy controlled legal systems and land. After all only 10% of the people in England prior to the birth of the USA owned any land. Compare that to the ownership rate of 90% in the British controlled new world (eventually the USA and Canada).

You think things have changed? You still can't get ahead because 'the man' is keeping you down? The only thing that is getting in the way is yourself, and your false belief that people care about your outward perception reflected in what you own.

"Baby I think we need a bigger home, all of our things can't fit in this house anymore. We've outgrown it." Oh you mindless stupid little shit. You have it completely ass backwards! You have too much stuff! Garage sale time!

The Chinese live in a dictatorial communistic regime, with an incredibly high income tax rate. Yet, they're still able to save around 45% of their income. What's your excuse?

Now on a more personal note. Crass Cash received his annual bonus today. While I'm very grateful to my employer for giving me more money in exchange for my labor and increasing skill set, I'm severely fucking pissed that the federal government took over 1/3 of it to fund their little pet projects. "But, CC they use that money to pay for roads, education, police, and hospitals. How could you be against that?". Actually all of that gets paid for with local/state taxes (property and sales tax) and the gas tax, all of which I paid this month. The overwhelming majority of your tax dollars goes to medicare (Obese white people who drive everywhere), social security (I'll never see any of this), and the military who defends our borders from Canada (USA's Mortal Enemy) and Afghanistan (where are they again?). With that said, I'm not going to let those asshats in Washington hold me back. 100% of that will go towards investments, so that one day I can structure my income to pay little to no taxes. See how that works?

-CC

RSS Feed

RSS Feed