Yesterday I set up my Health Savings Account (HSA) and I decided to go with Wells Fargo. It was a hard and also easy decision to make. It was hard in that frankly not a lot of banks or financial institutions even offer these types of accounts. After finding a few, it was then easy to figure out which one to go with.

I decided on Wells Fargo because they allowed for a discontuation of monthly fees after the account reached $5,000 in end of the month assets. Otherwise they're going to charge you $4.25 a month. I hate fees and find this to be shit, but it shouldn't take longer than a year to supply that size of a fund. There is a way though to only have to pay one month of fees, assuming you have the money to do it. Open the account in December and fully fund it with the $3,300 (individual) and then add another $1,700 in January for 2015. Then keep adding to it until it reaches $5,000.

Another thing I liked was that Wells also had a greater variety of mutual and index funds to choose from. I most like will allocate the amounts that I accumulate between an index fund and also a bond fund. 90% stocks and 10% bonds.

Simply put HSAs are fucking awesome! If somebody at the age of 35 starts maxing out the limit of $3,300 each year until they reach 65 when Medicare kicks in (although I'm sure the age will be pushed back by then). Then that person will have an account worth over $300,000 assuming a return of 7%.

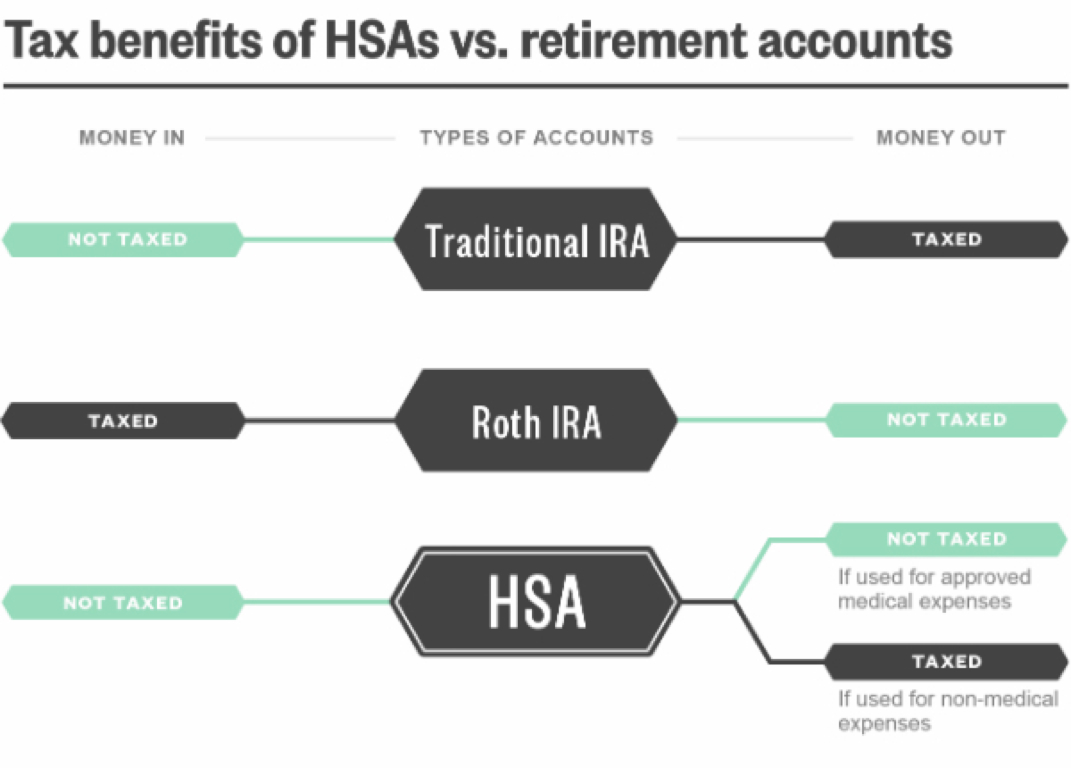

That money is put in tax pretax, grows tax free, and can be withdrawn tax free if used for medical expenses. At the age of 65 or order you can even withdraw it and only pay ordinary income tax on the proceeds. Just like a regular IRA! It's another tax shelter!

If you can afford it. Pay normal medical expenses out of your emergency fund and don't touch your HSA. Just let compound interest do it's thing. Hopefully by the time you turn 65 you'll never have to worry about paying any medical expenses.

-CC

RSS Feed

RSS Feed