Why a Health Savings Account?

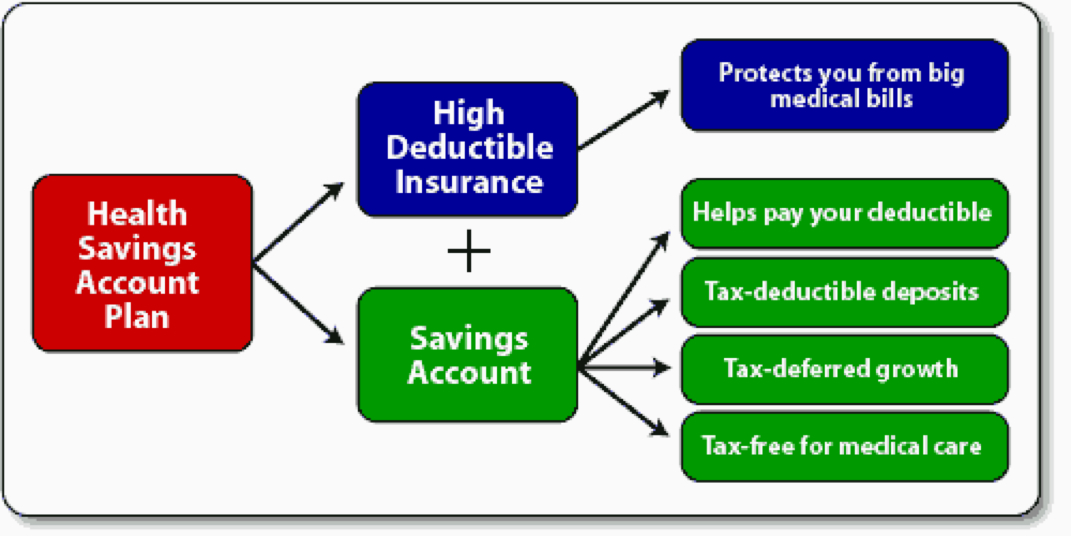

Theoretically, HSAs are meant to be a way for you to use before-tax money to pay for your healthcare costs when you have a high-deductible plan (meaning your deductible is at least $1,200 a year for an individual or $2,400 for a family before your insurance benefits kick in). But they have morphed into something more than that, thanks to their triple tax advantage:

- Your account contributions are pre-tax or tax-deductible.

- All earnings, interest, and, yes, investment returns are tax-free.

- Any withdrawals for qualified medical expenses are tax-free. Plus, once you reach age 65, all nonmedical withdrawals are taxed at your current tax rate, just like a traditional IRA. (If you withdraw money for nonmedical expenses before you’re 65, then there’s a 20% penalty.)

With big chunks of Obamacare taking effect at the beginning of 2014. You will be required to have health insurance or face a penalty. This may be a good way for all people, especially young healthy ones, to minimize their tax bill and also get the cheapest insurance.

I went on the exchange recently and yes it still sucks. It took me over 4 hours to sign up and get a quote, but I was at least in the end able to find a price before it froze. The cheapest ones will most likely be the high deductible (like all insurance) which many times will qualify it for an HSA account.

Assuming you're in a 25% tax bracket you could save around $825 a year in taxes. This money grows tax free and also can be withdrawn tax free for medical expenses like paying for Medicare premiums! BOOM droppin' knowledge!

RSS Feed

RSS Feed