-Milton Friedman

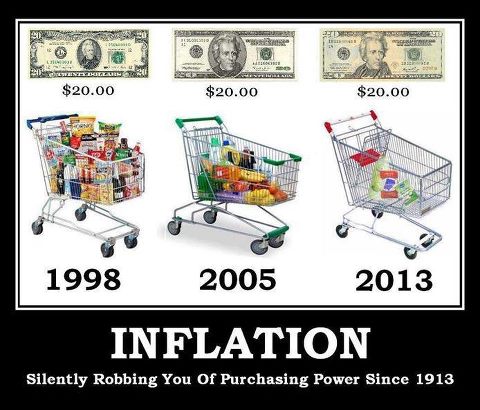

I was thinking yesterday about how the specter of inflation is looming over this country. The massive amounts of money creation by the federal reserve will eventually show up. According to my economic training and according to history, this could take many years and up to a decade to start showing up. Oh how time flies! It could be as little as just 10 years from now before we start seeing the effects.

So how do you protect yourselves from this wealth crippling man-made act? With the exception of living like Daniel Suelo who completely gave up money over a decade ago, it's almost impossible to 100% protect yourself. But there are certain things that you can do to help. Here's the definition of inflation: too much money chasing too few goods. You can't do anything about the too much money part, but you can chase less with few goods. Here's how!

Housing: buy a home and get a fixed rate mortgage and stay there forever. Be sure to pay it off as fast as possible and be sure to utilize all of the property tax exemptions that the county offers you. In the state of Florida you get a $25,000 deduction on the value and also the increase can't go above 3% a year for as long as you live there. Also don't do the classic American fad of constantly trading up your home. This creates and puts you at the mercy of inflation. Never borrow more via a mortgage than you owe right now.

Auto: get a bike a ride it as much as possible. This is free and it puts less wear and tear on your vehicle. If this isn't a 100% option than look at getting a vehicle for less than $5,000. These cars do exist and they could still have another 100,000 more miles left on them, which means in 10 years you'll probably get your money back or at least $3k for a scrapped vehicle. If you still don't find this to be a plausible option because like me you're will to pay for safety, then get a new vehicle or one thats a few years old and then drive it for at least 10 years. Major safety upgrades don't usually happen for 10 years and if you buy a reliable vehicle you should be good for 10 years to 100-150k miles on newer vehicles.

Food: Go on a BOGO diet, shop at farmer's markets, and start growing your own food. Never ever throw any food away! Food supplies you with calories until you die and if you throw some away it's just like throwing money away. If you want to get extreme about this (but not dumpster diving extreme) then you should look at contacting your local grocery store. Ask the manager if they will sell you food that has expired and that they're getting ready to throw out. They may actually give it to you, but don't look too greedy up front. Just suggest both options right away. There is a prodigious about of food in this country that gets thrown away every day. Don't let it go to waste!

Clothing: Goodwill, salvation army, and freecycle are all great ways to get really cheap clothes that quite simply never seem to cost more than they did a decade ago. Use up, reuse, wear out, and recycle! If you need something repaired and can't do it yourself. Go to a taylor or shoe cobbler to have them mended rather than just trashing it and buying another.

Utilities: the only thing you can really do for this, other than going without water and electricity, is to conserve as much as possible. Replace bulbs with more efficient ones. Get energy savings appliances, use less water, etc. Solar panels aren't really worth the money yet, but solar hot water is.

Entertainment: always look to the library first! Among the three libraries that I below to, I can get 90% of all my books and movies for free.

The less total dollars you spend the less inflation impacts you, period!

RSS Feed

RSS Feed