This is the much more logical route to getting rich. Think about it. Retiring and getting rich requires a plan, unless you plan on winning the lottery (that's not a plan, that's a stupid). Have you ever gotten in the car for a long road trip and never though about where you were going before you left? Of course not! You knew where you were going before you ever left!

The same goes with financial planning. You need to know how you want to live, where, and when in order to plan accordingly. Here's how...

1. Track your expenses. How much do you live off of now? You don't need a budget in order to do this, I've never had one! But you do need to track every penny of your expenses. Sorry, but you have to.

2. How do you want to live when you retire or become financially independent? In order to do that you need to figure out how much you want to live on each month. The same as you do now? A certain percentage of your income?

3. Next you need to run the numbers as to how you get there. This is like picking the roads that you're going to travel to a new location. Are you going to take the interstate, toll roads, or the scenic route?

4. Variables: How long until you retire? What's the expected rate of return for your investments? How much will you need adjusted for inflation? How much have you already saved? How much will you need to save each month/year? All of these will need to be answered before we can figure it out.

5. Running the calculation. Here's an example. Let's say you want to retire by 60 with $1,500,000 adjusted for inflation. That'll give you conservatively $45,000 to live off of each year without having to eat into the principle. You're 30 years old and have $25,000 saved for retirement.

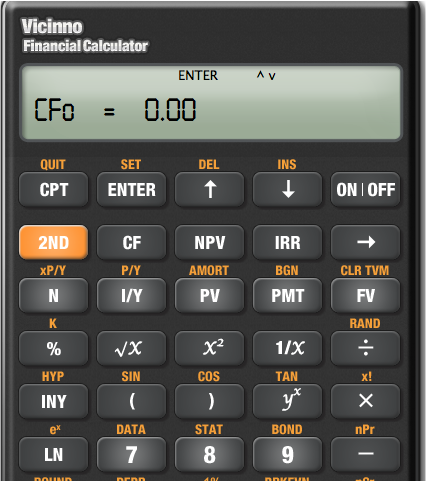

6. Whip out your handy financial calculator (see above) and put in the following values:

N = 30

I/Y = 7.5

PV = 25000

PMT = ?

FV = 1,500,000

You're trying to find out how much you need to save each year, so that's why PMT has a "?". That's what you're trying to solve for. When we run the calculation we come to a value of $16,623. What does that mean? That's the amount that you'll need to save each year in order to hit your goal of $1,500,000 by the time you're 60. Divide that by 12 and you need to save $1,385 each month.

7. Getting there. You see that your current income and budget analysis doesn't get you there. What do you need to do? There are only two variables in this equation: income and expenses. You either need to make more money (can be limited or difficult) or you need to spend less (easier and more realistic). A combination of the two is suggested.

Let me know if you need some help running this calculation...

RSS Feed

RSS Feed