This is an extremely popular question. There are websites dedicated to this one question and countless books. Here is the problem! They all come up with a different number. Why? Because they all use different assumptions and none of those assumptions are wrong. Life is highly unpredictable!

As a demonstration of this reality, we're now seeing an entire generation who has not saved enough or who did not plan on such a bad a stock market.

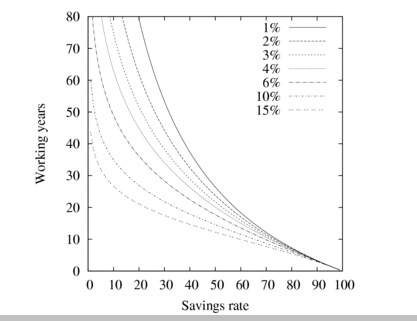

With that said, I can protect you from most of that. Yesterday you decided (at least temporarily) how much per year you wanted to live off of for retirement. Now take that amount and divide by 4% (0.04). If you want to be conservative divide by 3%. I'll discuss the difference tomorrow.

So theoretically, you can do what you want for $35,000 per year. That gives you (35,000/.04) $875,000 in assets that you will need to accumulate before you can retire. Now compare that with how much you have.

Since most of you just soiled yourselves. Go put on a new pair of underwear and regroup. The good news is you're way ahead of the game because the vast majority of Americans don't even know what they need to shoot for. They roll up on 65 with $100k and they think they're in good shape.

So now we're getting somewhere. If you decide to work part time while in retirement, then you can save yourself $125,000 in assets per $5,000 dollars that you make from working.

RSS Feed

RSS Feed