The way that it's calculated means that yes it is completely possible to have a negative savings rate due to the fact that you're actually spending more than you make. If you make $100,000 and you spend $101,000 then you have a 1% negative savings rate. If you do this one year of your life it's no big deal, but if you do it for decades you're royally fucked!

On top of this we're not talking about 1% we're talking about over 15%!!! That's pathetic! That means if you're an engineer making a great salary, you're not just living paycheck to paycheck, you're blowing an extra $1,000 a month of frivolous shit!

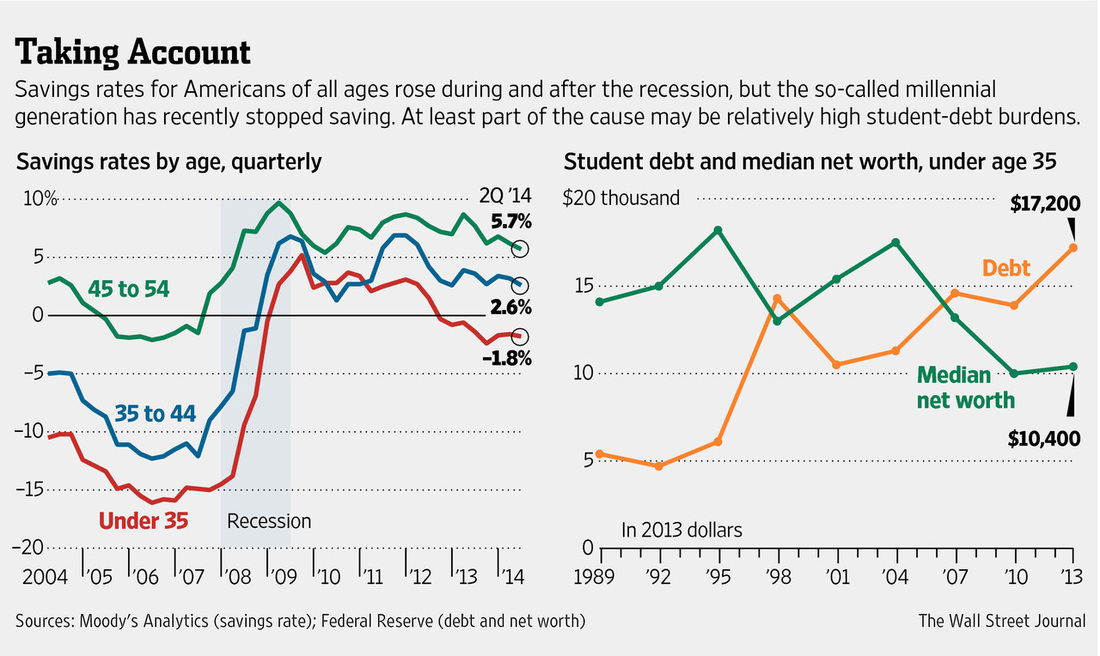

Here's the most interesting thing about the graphic above. Notice that the savings rate was worst BEFORE the Great Recession, not after. This means when everybody was flush with cash they were actually saving less, not more. Then as the recession broke they realized what a shit storm they were in, started saving money and now as the economy slowly gets better, they're going more and more back to their spending ways.

This completely dispels the myth that people don't make enough to save. I completely agree that there are those people out there, but when you take in the consideration of an entire generation it's simply not true. The author tries to pin it on student loan debt and I'm sure that doesn't help, but give me a break the average student debt loan is around $30k, which might seem like a lot, but it's noting more than another car payment. FYI those get paid off in 5 years. How many Millenials do you know that paid off their student debts in 5 years?

Drive your car for 10 years and pay off the student loans. Then pay for the next car in cash and put as much away for retirement as possible.

RSS Feed

RSS Feed