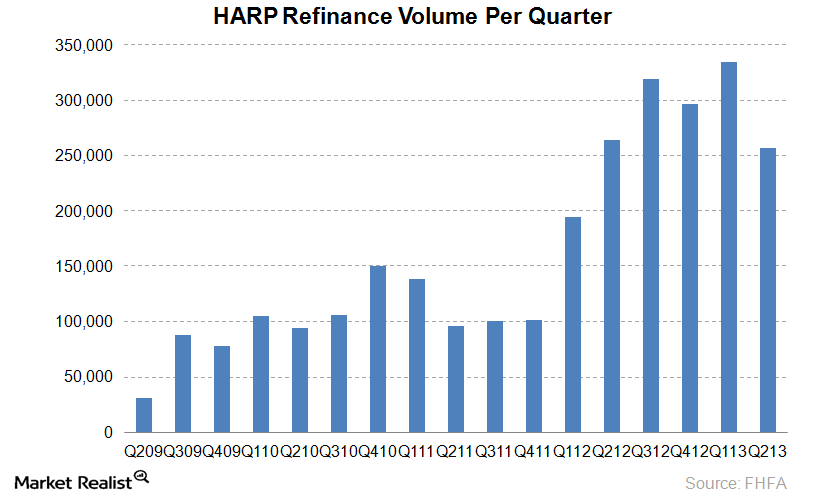

If your home is worth less than what you owe on it, or even if it's worth more, but you can't refinance because it's not worth more than an equivalent of 20% down. Then you need to look into HARP (Home Affordable Refinance Program). After talking to a number of mortgage brokers through my own real estate dealings, they say that they've been slammed with these deals.

HARP has been one of the few if only government programs that has seemed to live up to its initial ambitions. Now that bankers are confident that home prices will continue to rise, they've been willing to move like a bat out of hell to get this done. Not to mention they receive a nice kickback from the govt.

"Borrowers who refinanced under HARP have saved an average of $328 every month, according to a March study by Fannie Mae. HARP activity dropped after interest rates jumped, rising from around 3.6% in May to 4.6% by late June. Still, analysts at Goldman Sachs Group Inc. estimate that some 580,000 borrowers who are eligible could save at least $150 per month by refinancing. The program expires at the end of 2015." according to the Wall St Journal.

If you think you fall into this category, then contact some banks (large, medium, and small) and if those fail, then you'll want to look for a mortgage broker to see why you got rejected under HARP by all of these banks. This ends in 2 years and interest rates are rising, so you better get on it!

|

0 Comments

Leave a Reply. |

AuthorThis website was created due to the atrociously misguided financial advice that I've heard over the decades. Financial freedom is not intellectually strenuous, but it takes discipline. Categories

All

Archives

October 2017

|

RSS Feed

RSS Feed