What this means is that transactions that happen as if they were outside your business would be taxed differently than if they were apart of it. Specific transactions like capital gains, interest, charitable deductions, 1231 transactions, real estate transactions, etc. are all taxed at different rates than ordinary business income and C corp business income.

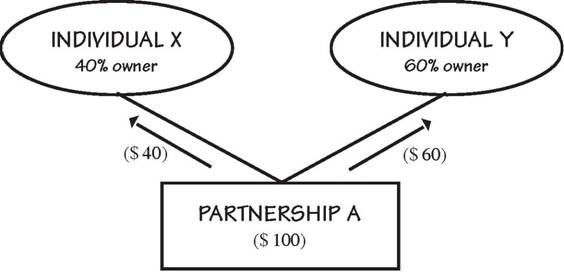

There is a distinction as to how partnerships and S corps are structured, but however that might be the ordinary income from the business and the other flow through transactions are split up between or among the partners. They then filter down to your tax return via what is a called a K-1.

When you receive a K-1 for your taxes, this tells your CPA what transaction and how much applies to you, so that it can then be put onto your taxes. This is a remarkably simple and complicated system. It can be a real pain, but it also gives American businesses the flexibility to run their businesses so as to minimize their taxable income.

-CC

RSS Feed

RSS Feed