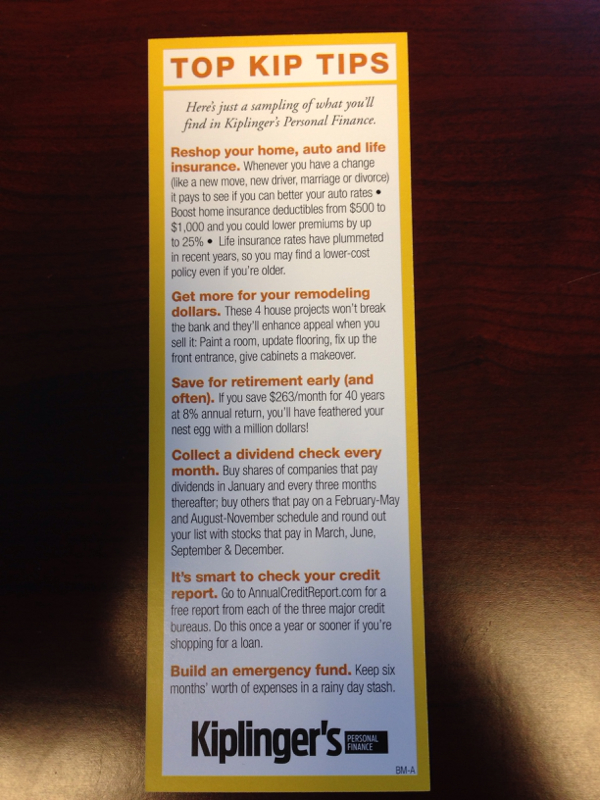

Here's 6 tips on the back of a bookmark I received. All are good!

1. Reshop your home, auto, and life insurance. Whenever you have a change (like new move, new driver, marriage, or divorce) it pays to see if you can better your auto rates. Boost home insurance deductibles from $500 to $1,000 and you could lower premiums by up to 25%. Life insurance rates have plummeted in recent years, so you may find a lower-cost policy if you're older.

2. Get more for your remodeling dollars. These 4 house projects won't break the bank and they'll enhance appeal when you sell it: paint a room, update flooring, fix up the front entrance, give cabinets a makeover.

3. Save for retirement early. If you save $263/month for 40 years at 8% annual return, you'll have feathered your nest egg with a million dollars.

4. Collect a dividend check every month. Buy shares of companies that pay dividends in January and every three months thereafter. Buy others that pay on a February-May and August-November schedule and round out your list with stocks that pay in march, June, September, & December.

5. It's smart to check your credit report. Go to annualcreditreport.com for a free report from each of the three major credit bureaus. Do this once a year or sooner if you're shopping for a loan.

6. Build an emergency fund (this should be number 1). Keep six months to a year's worth of expenses in a rainy day stash.

Here's 6 tips on the back of a bookmark I received. All are good!

1. Reshop your home, auto, and life insurance. Whenever you have a change (like new move, new driver, marriage, or divorce) it pays to see if you can better your auto rates. Boost home insurance deductibles from $500 to $1,000 and you could lower premiums by up to 25%. Life insurance rates have plummeted in recent years, so you may find a lower-cost policy if you're older.

2. Get more for your remodeling dollars. These 4 house projects won't break the bank and they'll enhance appeal when you sell it: paint a room, update flooring, fix up the front entrance, give cabinets a makeover.

3. Save for retirement early. If you save $263/month for 40 years at 8% annual return, you'll

RSS Feed

RSS Feed