There is something similar to this when it comes to dramatically increasing one's income. Only the poor and wealthy can really increase their income dramatically. The poor by getting more jobs and expanding their skill set and the wealthy through sheer mathematics (compound interest). When you become mega wealthy it actually becomes very difficult to not make money, which is why so many give their money away.

That's why it's better for the other 80% of society to reduce their consumption in order to achieve financial independence. It's a lot like weight loss. You can either cut your caloric consumption by 1,000 calories (not that difficult when you see what's in the crap we eat) or you can start running 10 miles a day (increase your metabolism). It's best if you do both, but from what personal trainers tell me; 80-90% of weight loss is from a change in diet.

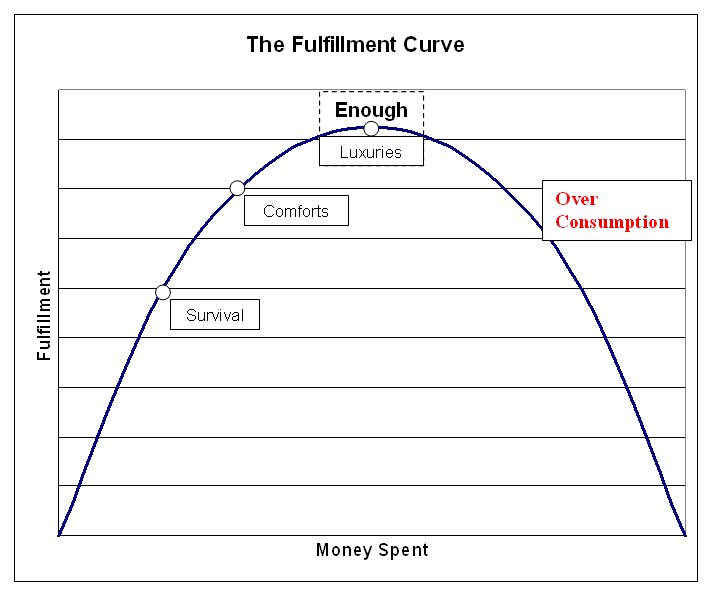

The same applies to your finances. It's much easier to just reduce your consumption by half than to increase your income by 100%. It's not how much you make, but rather how much you save. Remember from an earlier post that once your basic life needs are met (food, water, shelter, COACH, etc.) than the happiness that one derives from spending more money declines exponentially. Would you rather be free or own more stuff?

RSS Feed

RSS Feed