Robert Kiyasaki once said, "That assets feed you and liabilities eat you." I've come to find this to be absolutely true and no better example over the past decade is APPLE.

Apple pays $12.23 per year for each share for a yield of 2.3%. However if you bought it 10 years ago for $11 then you'd be receiving over 100% return on your investment each year!

This is the goal of buiness owners. People who own businesses for the long term want to the cash flow that comes from the businesses, not necessarily the future price appreciation.

Warren Buffett is another great example of this. He pointed this out in his recent annual report when he spoke about his real estate investments. You can also see this in his acquisition of Sees Candy from back in the 80s. His company now earns way more per year than his entire initial investment!

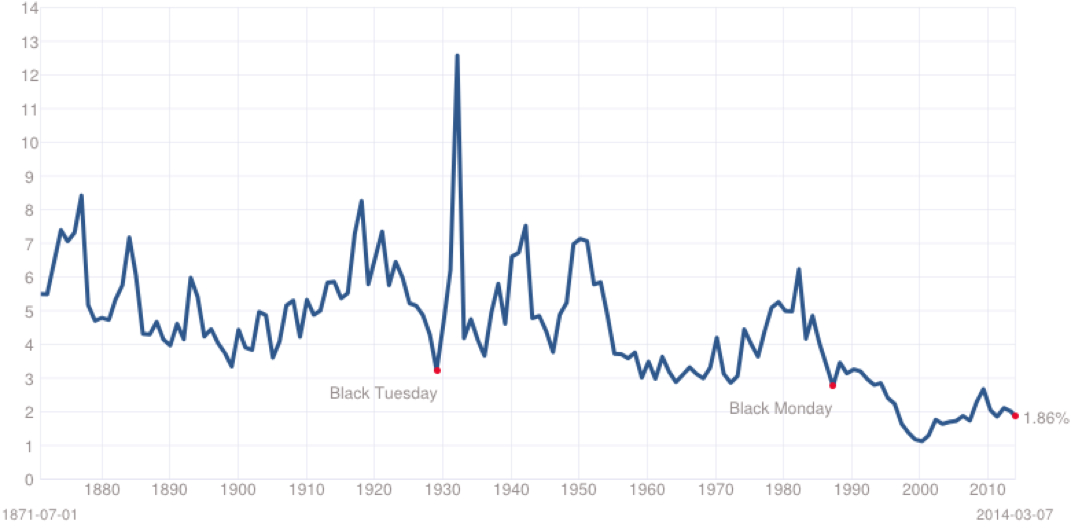

While these examples are extreme lets just look at the dividend growth of an ETF. The dividends for Fortune 500 companies have grown 90% since the .com bubble burst. However they have to go up by considerably more for you to make 100% on your money each year. It does happen though and it will, but you have to trust that in decades it will pay off. Just like Warren Buffett had to trust...

RSS Feed

RSS Feed