One of my grandfathers retired around the traditional age of 65. After pacing around the house for a week and annoying my grandmother he decided to go back to work for the person that he sold his business to. He continued to work there for another 10 years. As a result, his doctor told him that he probably added another 10 years to his life. He ended up living to 95, when the average life span at the time of his birth was 55.

First determining what sort of lifestyle that you want is key to planning a retirement, because you're going to need to find out how much money you will need in order to sustain you for the rest of your life. Many traditional retirement calculators often try to figure this out by taking a percentage of your income. Since pay day is either today or tomorrow for many people, be sure to calculate what you currently bring home (take home pay) and what your employer actually pays you. If you want to maintain your lifestyle, then that percentage is what you should use. If you want to travel the world non-stop and you figure it's going to take 110% of your gross income then that needs to be used. If you plan on sitting around the house and your mortgage will be paid off, then you could probably live off of considerably less.

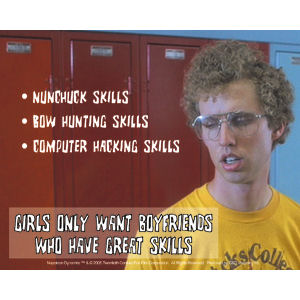

My personal retirement would be akin to traveling around the world for 2-3 month intervals, while living in 2 different geographical locations depending upon the season. I don't know if you've noticed or not, but FL sucks in the summer time! All the while working somewhere between 4-8 hours a week, to earn some extra money and to maintain my skills (nunchuck skills, bo hunting skills, computer hacking skills).

RSS Feed

RSS Feed