This article appeared in the WSJ yesterday, but it's really misleading to the average American. First of all it can't happen to us. Here's the crux of how it happens...

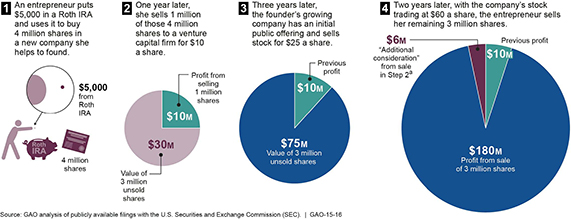

"In the first example, an entrepreneur contributed $5,000 of “founders’ shares” in a business to a Roth IRA in 2008. The original value of the shares was $0.00125 each. The company went public in 2012 at $25 a share. The account grew to $196 million by 2014."

This is similar to how Mitt Romney was able to build such a substantial IRA account. His children also have pretty large accounts, but it has to do with gifting them the tax free minimum of $14,000 since the day they were born. None of which is even remotely illegal or unethical. It just come from knowing the tax code.

That type of situation is not open to most of us. It's more like hitting the lottery for something like that to happen to anybody. With that said there's no reason why somebody who doesn't start young enough can't build a very nice nest egg.

If you're 25 now and you want to retire at 65 like most people than $1,900,000 tax free dollars. This assumes that you put away the maximum of $5,500 each year and that you make a non-inflation adjusted return of 9.2%. Not too shabby!

If you're expecting to do better than this, than you're either smoking crack or you're Warren Buffett. It's not impossible, I just wouldn't bet my life on it.

RSS Feed

RSS Feed