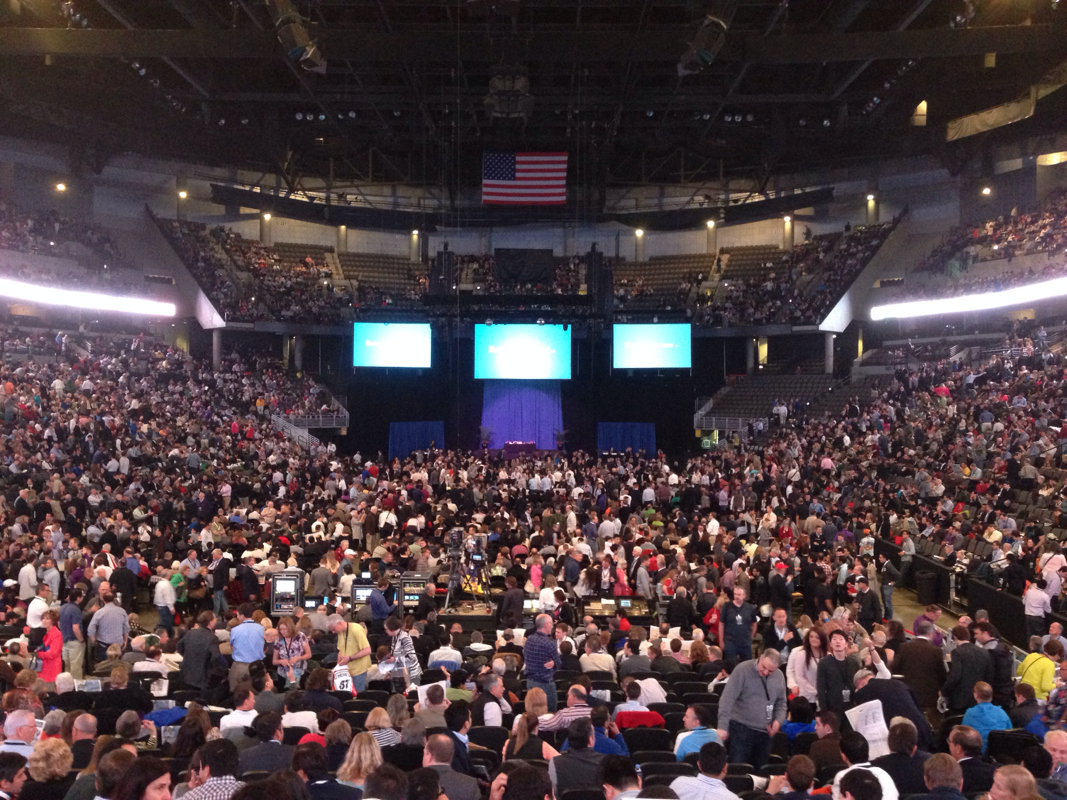

For the past 6 years I've been going to Omaha to listen to Warren Buffett and Charlie Munger speak at the Berkshire Hathaway annual meeting. Here are the notes that I wrote down concerning the wide range of their subjects...enjoy!

-Concerning Coke directors payment plan: Buffett talked to CEO at Coke to express his dislike of the excessive plan. Had no desire to go to war with KO over this.

- American business is doing very well. Earnings have been excellent.

-Berkshire is only company that talks about its intrinsic value. IV is an imprecise measure and fluctuates quarter to quarter.

-Reputation needs to be built for buying and holding private companies. You have to make the promise and keep it.

-Buffett does not think that Howard Buffett (son) voting for Coke's company package will show that it reflects badly on Berkshire's future culture.

-Buffett paid probably 10-11 times after tax earnings for Nebraska Furniture Mart.

-Putting money into index fund for wife at time of death is for ultimate security instead of Berkshire stock.

-Buffett thinks MidAmerican will be able to generate 40% of energy for Iowa with wind.

-They don't think that publishing compensation figures for subsidiary CEO's of would bring down those companies' payroll expenses.

-Lack of oversight is prevalent at BRK. It's a double edged sword that allows for flexibility, but could cause problems.

-Sales of boxed chocolate is declining. Not much progress in moving the company geographically.

-Changed bank of america stock category in order to change it to non-calleable. It worked well for both sides.

-Finding a business to buy turns them on move than finding a stock to buy.

-Does not see climate change impacting pricing when it comes to insurance prices.

-More money will eventually be funneled to Todd and Ted as time goes on.

-Doesn't see anything that he'd do differently from the Fed Reserve policies.

-Doesn't think Fed monetary policy is causing a bubble.

-Munger thinks that owning a group of good business plans is not a horrible business plan.

-Disagrees that conglomerates are a bad business plan.

-Best to have a lot of cash then go all in when the market bottoms. However, they haven't figured out how to do that.

-Buying private companies is a more alluring proposition than public companies.

-Doesn't think that driving patterns will impact insurance rates. Doesn't think that Progressive will benefit from know people's driving patterns.

-Self-driving cars could seriously impact car insurance.

-You have to be realistic in your understanding of what your circle of competence is.

-Standard of living doesn't equate to cost of living. At one point it becomes a negative. Having more can cause more problems. Frugality helps Berkshire.

-Union Pacific has a better position for moving freight to/from mexico. Maybe in the future for BNSF, but not now.

-Intrinsic Value can't be perfectly valued because the future is unknown. The key factors are how much cash do you have to put in and how much cash do you get out.

-People don't copy BRK because it's slow and takes too long. Private equity wants fast results.

-Inflation would hinder BRK not help it.

-Prosecuting individuals vs companies is more effective. Fines are less effective than people going to jail.

-BRK has no desire to buy a sports team, nor athletic equipment producer.

-Very unlikely that BRK would participate in contributing to a FNM or Freddie Mac type of corp structure.

-Read book: DREAM BIG

-To get a god partner you need to deserve a good partner.

-Personal finance should be taught in schools as early as possible.

|

Editor: Crass Cash

0 Comments

Leave a Reply. |

AuthorThis website was created due to the atrociously misguided financial advice that I've heard over the decades. Financial freedom is not intellectually strenuous, but it takes discipline. Categories

All

Archives

October 2017

|

RSS Feed

RSS Feed