Tax credits are wonderful because they come right off your tax bill 100% rather than at the marginal rate that you get taxed at. Which means if any of these apply than you really really need to take advantage of them. Here are 5 tax tips from the IRS newsletter:

Five Tax Credits That Can Reduce Your Taxes

Tax credits help reduce the taxes you owe. Some credits are also refundable. That means that, even if you owe no tax, you may still get a refund.

Here are five tax credits you shouldn’t overlook when filing your 2013 federal tax return:

1. The Earned Income Tax Credit is a refundable credit for people who work but don’t earn a lot of money. It can boost your refund by as much as $6,044. You may be eligible for the credit based on the amount of your income, your filing status and the number of children in your family. Single workers with no dependents may also qualify for EITC. Visit IRS.gov and use the EITC Assistant tool to see if you can claim this credit. For more see Publication 596, Earned Income Credit.

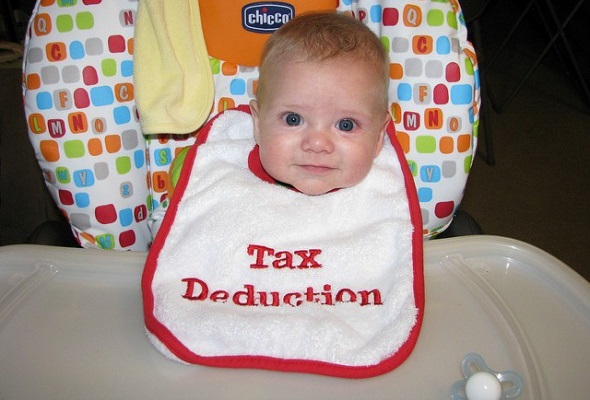

2. The Child and Dependent Care Credit can help you offset the cost of daycare or day camp for children under age 13. You may also be able to claim it for costs paid to care for a disabled spouse or dependent. For details, see Publication 503, Child and Dependent Care Expenses.

3. The Child Tax Credit can reduce the taxes you pay by as much as $1,000 for each qualified child you claim on your tax return. The child must be under age 17 in 2013 and meet other requirements. Use the Interactive Tax Assistant tool on IRS.gov to see if you can claim the credit. See Publication 972, Child Tax Credit, for more about the rules.

4. The Saver’s Credit helps workers save for retirement. You may qualify if your income is $59,000 or less in 2013 and you contribute to an IRA or a retirement plan at work. Check out Publication 590, Individual Retirement Arrangements (IRAs).

5. The American Opportunity Tax Credit can help you offset college costs. The credit is available for four years of post-secondary education. It’s worth up to $2,500 per eligible student enrolled at least half time for at least one academic period. Even if you don’t owe any taxes, you still may qualify. However, you must complete Form 8863, Education Credits, and file a tax return to claim the credit. Use the Interactive Tax Assistant tool on IRS.gov to see if you can claim the credit. Publication 970, Tax Benefits for Education, has the details.

|

0 Comments

Leave a Reply. |

AuthorThis website was created due to the atrociously misguided financial advice that I've heard over the decades. Financial freedom is not intellectually strenuous, but it takes discipline. Categories

All

Archives

October 2017

|

RSS Feed

RSS Feed