I'm talking about true content happiness, not fleeting moments of orgasmic bliss! This in turn creates an evil cycle where they then have to borrow money to pay for these euphoric excesses, which then means they have to make more money, which they think can only be done by working more. They end up sick, in debt, with a broken marriage, surrounded by people who don't know them. They end up on a treadmill of unhappiness, which they bought online...

|

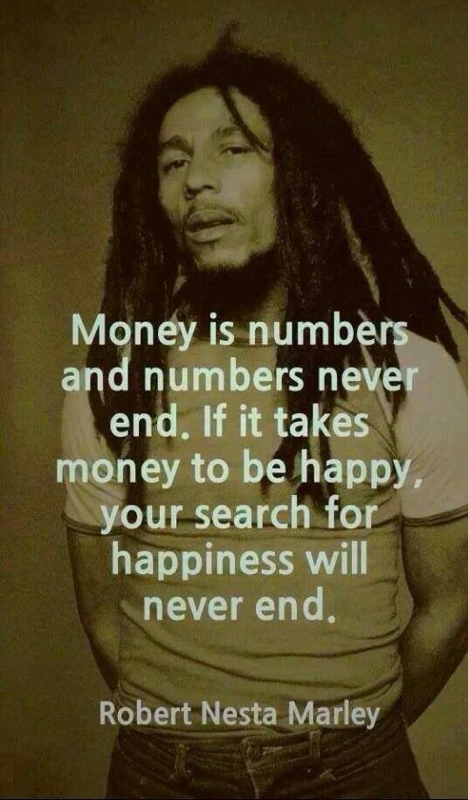

Editor: Crass Cash A friend of mine and I were talking the other day about the problem with modern day hyperconsumerism. He described the American consumer as somebody with a hungry mouth, but no stomach. If you ever watch peoples spending habits you'll see how perfect of a description this is. People buy buy buy all day long and never once look at whether what they're purchasing makes them happy or not.

I'm talking about true content happiness, not fleeting moments of orgasmic bliss! This in turn creates an evil cycle where they then have to borrow money to pay for these euphoric excesses, which then means they have to make more money, which they think can only be done by working more. They end up sick, in debt, with a broken marriage, surrounded by people who don't know them. They end up on a treadmill of unhappiness, which they bought online...

0 Comments

Editor: Crass Cash Summer is rapidly making its way to a city near you! Living in the southern US means the worse part of the year is coming. Not just for weather, but for your utility bill. So here are some tips to help for the coming months, no matter where you are.

1. Get your AC unit serviced to make sure it's topped off with freon and also to make sure the condenser is clean. Both will allow for it to run as efficiently as possible. 2. Replace the AC filter. Go with the pleated filters, not the cheap meshed ones. No need to get the name brand though, they're a waste of money. 3. Clear away the vegetation from around the condenser, but don't forget to plant a tree. Trees can help shade your house as long as you plant them on the west or south side of the house. This of course assumes that you live in the Northern hemisphere. 4. Put in some ceiling fans if you haven't already. This helps regulate the temp in the room more efficiently and also allows for you to keep the thermostat at a higher temp. 5. If your AC unit is more than 10 years old and you live in a hot climate, then you should look at getting a whole new unit. I'd wait one more season though to see if you can get it installed in the fall, winter, or spring. AC unit prices have a tendency to go up in the summer time. 6. Strategically open your windows. On cool nights, open your windows and then close them when you wake up. This works especially well if you have a 2 or 3 story home, since heat rises it helps cool the entire house. By doing all of these things you could cut your cooling costs by half, which is quite a big deal if you have to run your AC unit for 6 months a year like me. Editor: IRS newsletter PAY ESPECIAL ATTENTION TO #9! Ten Things to Know about IRS Notices and Letters Each year, the IRS sends millions of notices and letters to taxpayers for a variety of reasons. Here are ten things to know in case one shows up in your mailbox. 1. Don’t panic. You often only need to respond to take care of a notice. 2. There are many reasons why the IRS may send a letter or notice. It typically is about a specific issue on your federal tax return or tax account. A notice may tell you about changes to your account or ask you for more information. It could also tell you that you must make a payment. 3. Each notice has specific instructions about what you need to do. 4. You may get a notice that states the IRS has made a change or correction to your tax return. If you do, review the information and compare it with your original return. 5. If you agree with the notice, you usually don’t need to reply unless it gives you other instructions or you need to make a payment. 6. If you do not agree with the notice, it’s important for you to respond. You should write a letter to explain why you disagree. Include any information and documents you want the IRS to consider. Mail your reply with the bottom tear-off portion of the notice. Send it to the address shown in the upper left-hand corner of the notice. Allow at least 30 days for a response. 7. You shouldn’t have to call or visit an IRS office for most notices. If you do have questions, call the phone number in the upper right-hand corner of the notice. Have a copy of your tax return and the notice with you when you call. This will help the IRS answer your questions. 8. Keep copies of any notices you receive with your other tax records. 9. The IRS sends letters and notices by mail. We do not contact people by email or social media to ask for personal or financial information. (THIS ONE IS BIG FOR FRAUD) 10. For more on this topic visit IRS.gov. Click on the link ‘Responding to a Notice’ at the bottom left of the home page. Also, see Publication 594, The IRS Collection Process. You can get it on IRS.gov or by calling 800-TAX-FORM (800-829-3676). |

AuthorThis website was created due to the atrociously misguided financial advice that I've heard over the decades. Financial freedom is not intellectually strenuous, but it takes discipline. Categories

All

Archives

October 2017

|

RSS Feed

RSS Feed